International Payment

We are removing global payment boundaries and laying the rails for the digital age. With our innovative approach, we are redefining international payment systems and delivering fast, secure, and accessible solutions beyond borders.

Why B2B Cross-Border

Still Hard

COMPLIANCE OVERHEAD

Access to fiat rails requires multiple banking relationships & licenses

SLOW RAILS

SWIFT routes in and out of emerging markets are slow because of perceived risk

INCREASING COSTS

Pre-funding increases costs in high-interest rate environment

DEBANKING RISK

Stablecoin flows get restricted by many banks increasing debanking risk

Unlocks New Revenue, Not Just Infrastructure, For Emerging Markets

No additional licenses

No new banking setup

No compliance burden

What Stable OS Unlocks for B2B Fintechs & Stablecoin Neobanks

Fintechs, Traditional Neobanks, Wallets

SWIFT routes in and out of emerging markets are slow because of perceived risk

Stablecoin flows through Stable OS, no risk to your current banking

Emerging market rails & currencies with risk optimized access

Stablecoin Neobanks, Wallets, OTCs

Global fiat rails without additional licensing or banking

Revolut like cross-border flows on behalf of your merchants on Day 1

Out-of-the-box compliance & risk management infrastructure

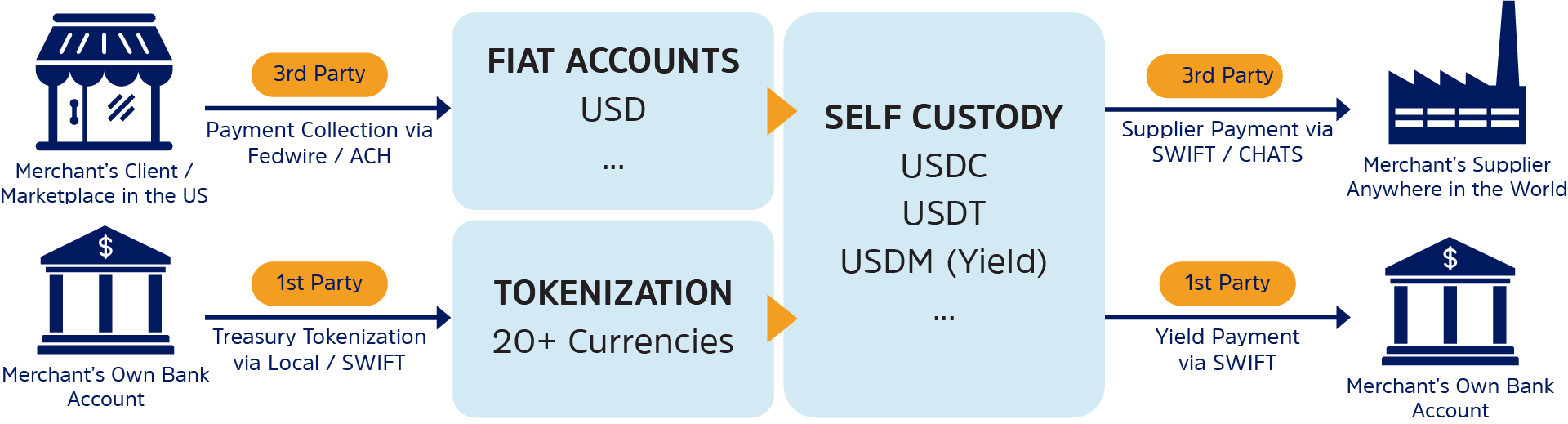

How Stable OS Works For Each Of Your Merchants

The Stable OS Wallet for Merchants is the perfect merge of fiat and stablecoin rails as well as self custody and yield bearing instruments in a single programmable access point.

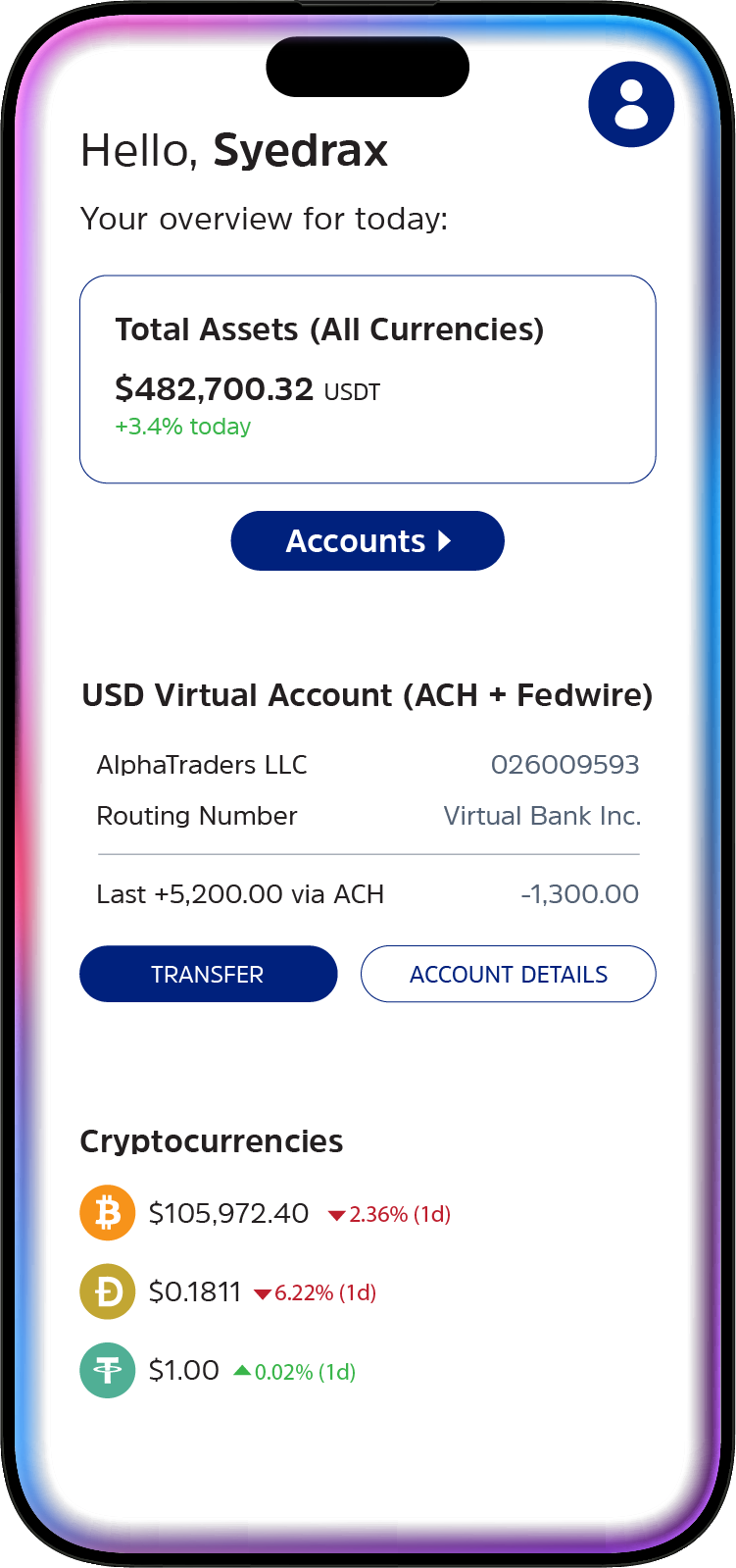

MERCHANT’S STABLEOS WALLET

Stable OS

The global operating system for stablecoins

USD named virtual accounts (ACH + Fedwire) for your merchants

Treasury Tokenization in 20+ exotic as well as G7 currencies

Access to “POBO” SWIFT, where your merchant is the actual Sender of the transaction

Seamless management of your merchants' accounts via API and Dashboard

Access to sophisticated financial instruments typically hard to obtain through TradFi

Stable OS In Numbers

TRULY GLOBAL

USD POBO SWIFT to 173 countries

HIGH-VALUE PAYMENTS

$400K+ USD per payment on average

EMERGING MARKET FOCUSED

+90% of flows in emerging markets

HYPER GROWTH

+60% QoQ in volume, 3x QoQ in

customer base

FAST & TRACKABLE

Overnight settlements and

100% trackability

GLOBALLY REDUNDANT

20+ banking partners ensuring

redundancy

Official Number : +90 554 461 57 76

Address : A, Ömer Avni, Serdar-ı Ekrem Cd. No:15, 34425 Beyoğlu/İstanbul

Email : info@syedrax.com